Telecom Regulatory Authority of India (TRAI) has published Yearly Telecom Service Performance Indicator Report for the year 2019. As per this latest analysis from TRAI, only two operators in India – BSNL & Jio – have recorded increase in market share and customer base in 2019 while all other operators including – Bharti Airtel, Vodafone Idea, Reliance Communication, Tata Tele Services, MTNL & Quadrant witnessed sharp decline in their over-all performance.

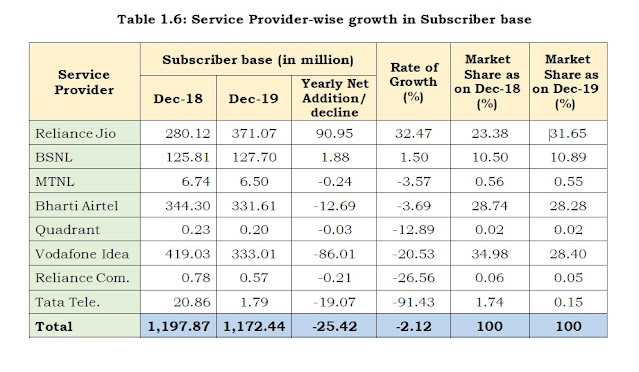

Reliance Jio could increase their customer base from 280.12 million at the end of December 2018 to 371.07 million at the end of December 2019 with annual growth rate of 32.47. During the same period, Jio’s Market share increased to 31.65% from 23.38%. State run telecom major – BSNL – the one and only public sector telecom company which is fully owned by Government of India – could increase their customer base to 127.70 million at the end of December 2019 from 125.81 million at the end of Dec 2018.

BSNL’s Exceptional Performance in Customer Addition without 4G

The one interesting factor we need to think about at this point of time is about this superior performance made by BSNL even without 4G services while all private operators are offering 4G services to customers. BSNL’s market share at the end of December 2018 was 10.50% with 125.81 million mobile customers all over India.

(Subscriber base includes both Wireless & Wireline Subscribers)

At the end of December 2019, BSNL was able to achieve 1.88 million net addition of customers with increased market share of 10.89%. Yearly growth rate of BSNL is 1.50% which can be considered better or even best as compared to Jio’s growth rate of 32.47% since Jio is offering 4G services while BSNL was not able to start their 4G mobile internet services because of non allocation of spectrum.

Vodafone Idea slipped to No.2 position in 2019

Vodafone Idea was the largest mobile operator at the end of December 2018 with massive market share of 34.98% and 419.03 million customers. But in 2019, the company recorded the highest decline in customer base as compared to all other operators in the country. Vodafone Idea lost nearly 86.01 million customers in 2019 with growth rate of -20.53%. Market share of Vodafone Idea at the end of December 2019 stood at 28.40% just behind Jio which is having 31.65% market share.

Bharti Airtel slipped to No.3 position in 2019

The story of Bharti Airtel is almost the same where the company lost around 12.69 million customers in 2019. Bharti Airtel was the 2nd largest mobile operator in 2018 with market share of 28.74% and 344.3 million customers. Bharti Airtel’s market share was reduced to 28.28% at the end of December 2019 with annual rate of growth of -3.69%.

Total Telephone Subscriber in India during 2019

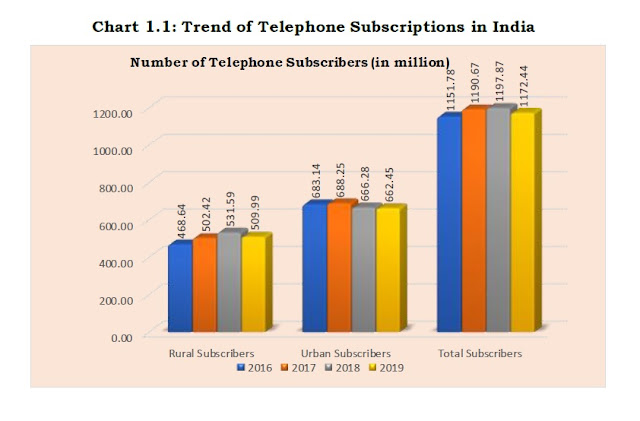

The number of telephone subscribers in India decreased from 1,197.87 million at the end of December 2018 to 1,172.44 million at the end of December 2019, registering a yearly decline rate of 2.12%.

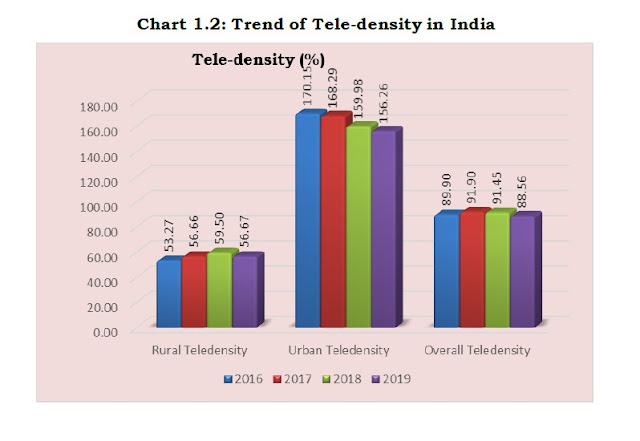

Telephone subscription in Urban Areas declined from 666.28 million at the end of Dec-18 to 662.45 million at the end of Dec-19 at the yearly decline rate of 0.57%. Urban Tele-density also declined from 159.98 at the end of Dec-18 to 156.26 at the end of Dec-19 with yearly decline rate of 2.33%.

Rural telephone subscription decreased from 531.59 million at the end of Dec-18 to 509.99 million at the end of Dec-19 at the yearly decline rate of 4.06%. Rural Tele-density also decreased from 59.50 at the end of Dec-18 to 56.67 at the end of Dec-19 with yearly decline rate of 4.75%.

Tele density in India during 2019

Out of the total telephone subscription, the shares of Rural telephone subscription decreased from 44.38% at the end of December 2018 to 43.50% at the end of December 2019. However, share of Urban telephone subscription in total telephone subscription, increased from 55.62% at the end of December 2018 to 56.50% at the end of December 2019.

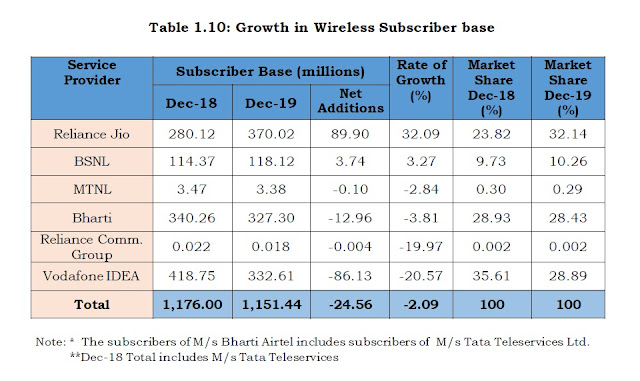

Growth in Wireless Subscriber Base in 2019

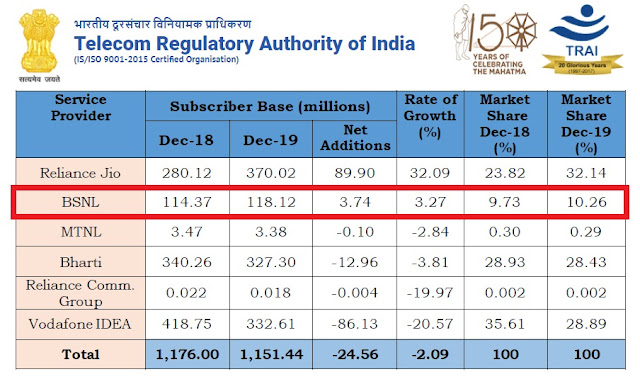

Reliance Jio became the market leader with 32.14% market share of total wireless telephone subscriber base at the end of December 2019 and Vodafone Idea Ltd slipped at second position with 28.89% market share.

In term of net addition, Reliance Jio Infocomm Ltd added maximum number of telephone subscribers of 89.90 million during the year 2019 and its yearly growth rate recorded as 32.09% during the year 2019. BSNL recorded yearly growth rate of 3.27% in 2019 with increased market share of 10.26% at the end of December 2019.

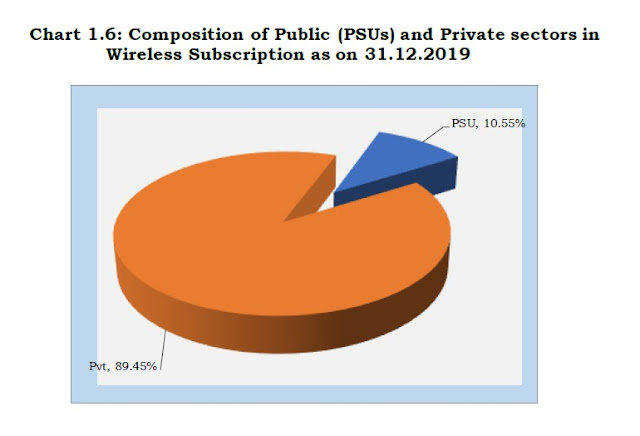

Private telecom service providers hold 89.45% market share of total wireless telephone subscriptions and PSUs (BSNL & MTNL) hold only 10.55% market share of wireless telephone subscription as on 31st December, 2019.

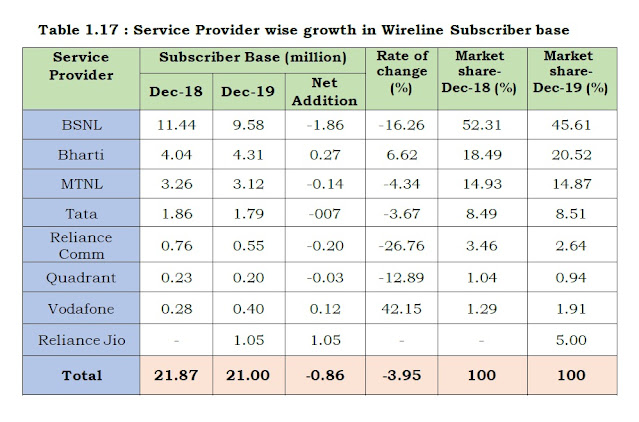

Growth in Wireline Subscriber Base in 2019

In total wireline subscriber base, PSUs hold 60.47% of market share at the end of December 2019 as against 67.24% at the end of December 2018. However, both PSUs, BSNL and MTNL showed decline in their wireline subscriber base during the year 2019.

Dear readers, please share your views and opinions about this spectacular performance made by our state run operator – BSNL via comments with us.

1 Comment

Inspite of hurdles created by the government BSNL performed well in comparison with other operators