India’s National Telecom backbone Bharat Sanchar Nigam Limited (BSNL) launched Mobile Money Transfer Scheme in association with Department of Posts (DOP) through Post Offices across India. The service enables instant money transfer from one place to another place using mobile, through Indian post offices.

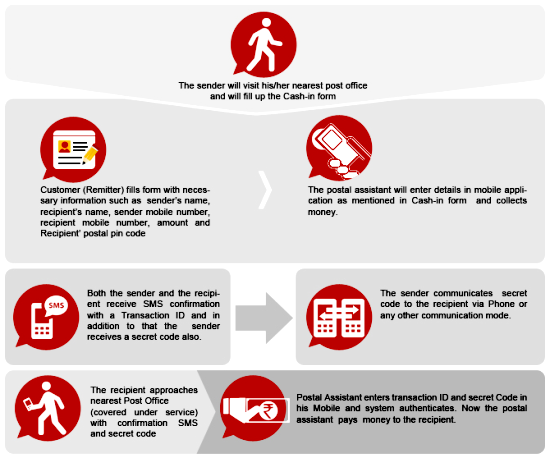

The process for money transfer is very simple to understand and follow. The remitter (sender) can submit money (Cash In) at any of the covered post office and automatically, the amount is transferred to a central position, which can be collected by recipient customer (Cash Out) from any of the covered Post offices.

For this initiative, India’s pioneer and largest communication service provider (CSP), BSNL will provide mobile connections to DOP’s designated officials and BSNL will bring Global technology for Mobile Money Transfer. Each Post office shall be provided with a mobile handset with pre loaded application by BSNL’s technology partner M/s Maverick Mobile Solutions.

Work Process

- The remitter (sender) can submit money (Cash In) at any of the covered post office and automatically, the amount is transferred to a central position, which can be collected by recipient customer (Cash Out) from any of the covered Post offices.

- As soon as the Cash in happens, both the sender and the recipient get a SMS on their mobile phones.

- The sender gets a Transaction ID and a Six (6) digit secret code in the SMS while the Recipient only gets the Transaction ID.

- Recipient can claim the money from any of the covered Post Offices by showing the Transaction ID that he receives on his mobile in the SMS and the Secret code, which he gets from the sender.

- In order to make process smooth and convenient, a notification sms is being sent to remitter as well as to recipient regarding transaction irrespective of their telecom operator.

- The recipient must collect money within 14 days of transaction.

- In case the recipient does not Cash Out the amount within 14 days, the amount is sent back to the sender and a Cash In reversal SMS with new transaction-id will be sent to remitter. The remitter can withdraw money within 7 days (prescribed) after this SMS.

Charges for Mobile Money Transfer Scheme

Features of Mobile Money Transfer Scheme

- Economical: Economical as compared to traditional money order, where rate is 5% of the amount to be remitted.

- Secure and Quick Delivery: DOP Money Remittance process enables you with smart quick and safe money transfer.

- Widespread Reach: Wide spread reach through larger number of Post Offices and ubiquitous BSNL GSM network as compared to similar other products from other banks/Telcos.

- Trusted Organization: Managed by the trusted organizations i.e. India Post, BSNL.

There is No limit on the number of transactions. However the minimum amount is 1,000 rupees while the maximum is 10,000 rupees. The Reciepient customer can go to any covered post office for Cash Out. It is not necessary to go to a particular post office with the Transaction ID and the Secret Code.

Dear readers, please share your views about this new initiative by BSNL & DOP via comments.