Telecom Regulatory Authority of India (TRAI) has released latest telecom subscription data for the month of October 2020. Jio and Airtel are the two operators added maximum numbers of new subscribers both in Wireless and Wireline segments during October 2020.

This latest TRAI report is a clear sign of market consolidation which is about to happen in Indian telecom market in coming days. It is expected that, the entire telecom market will get consolidated to maximum 3 or 4 operators where Jio & Airtel are supposed to take the leading role. From last few months, Jio started adding wireline subscribers at a faster rate which helped them to improve their wireline market share to 11.63% as on 31st October 2020.

Broadband Statistics In India

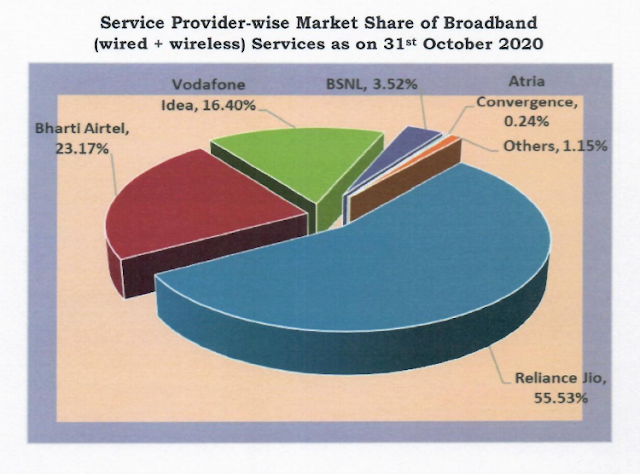

The number of broadband subscribers increased from 726.32 million at the end of September-2020 to 734.82 million at the end of October-2020 with a monthly growth rate of 1.17%. Top five service providers constituted 98.85% market share of the total broadband subscribers at the end of October-2020. These service providers were: –

- Reliance Jio Infocomm Ltd (408.06 million)

- Bharti Airtel (170.23 million)

- Vodafone Idea (120.50 million)

- BSNL (25.87 million)

- Atria Convergence (1.74 million)

Top Five Wired Broadband Service providers at the end of October 2020

- BSNL (7.75 million)

- Bharti Airtel (2.67 million)

- Atria Convergence Technologies (1.74 million)

- Reliance Jio Infocomm Ltd (1.70 million)

- Hathway Cable & Datacom (1.05 million)

Top Five Wireless Broadband Service providers at the end of October 2020

- Reliance Jio Infocom Ltd (406.36 million)

- Bharti Airtel (167.56 million)

- Vodafone Idea (120.49 million)

- BSNL (18.12 million)

- Tikona Infinet Ltd (0.31 million)

Wireline Subscribers Statistics in India

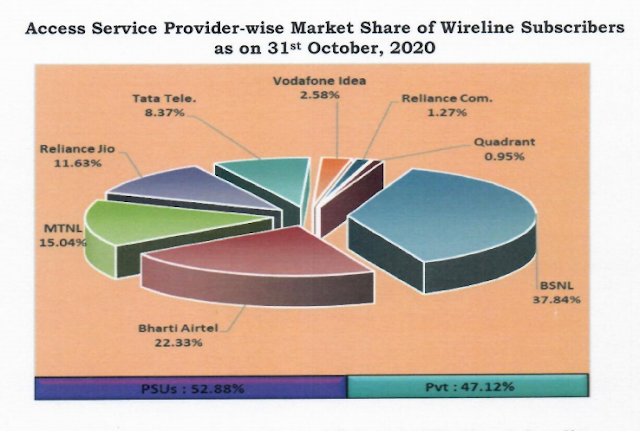

Wireline subscribers decreased from 20.08 million at the end of September-2020 to 19.99 million at the end of October-2020. Net decrease in the wireline subscriber base was 0.09 million with a monthly decline rate of 0.43%. The Overall Wireline Tele-density increased from 1.48 at the end of September-2020 to 1.47 at the end of October-2020. BSNL and MTNL, the two PSU access service providers, held 52.88% of the wireline market share as on 31st October, 2020.

Wireless Subscribers Statistics in India

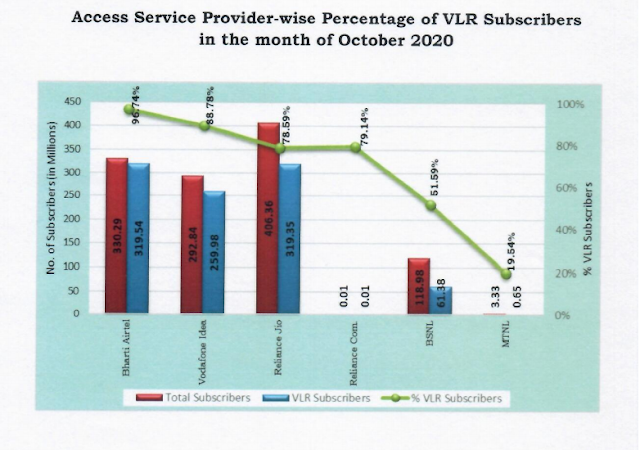

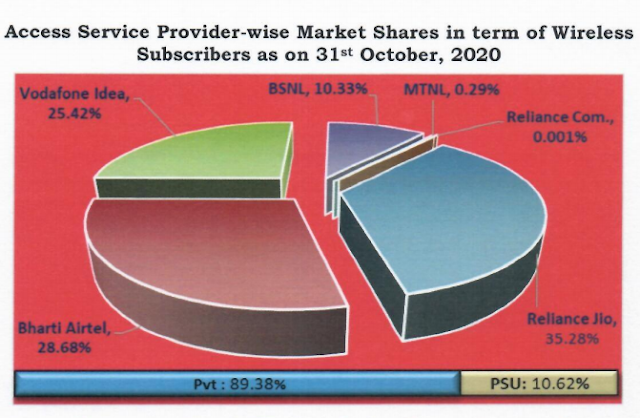

Total wireless subscribers (2G, 3G & 4G) increased from 1,148.58 million at the end of September-2020 to 1,151.81 million at the end of October-2020, thereby registering a monthly growth rate of 0.28%. The Wireless Tele-density in India increased from 84.74 at the end of September-2020 to 84.90 at the end of October-2020.

As on 31st October 2020, the private access service providers held 89.38% market share of the wireless subscribers whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 10.62%.

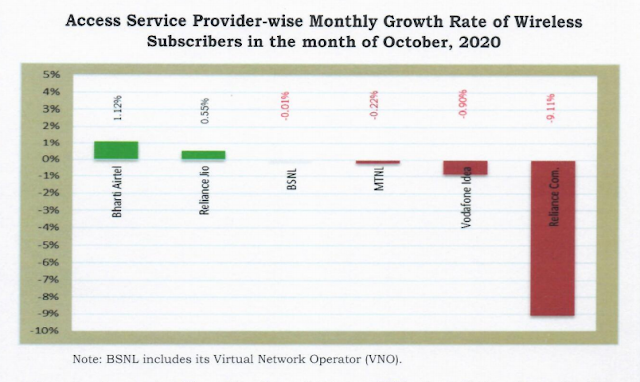

Growth in Wireless Subscribers

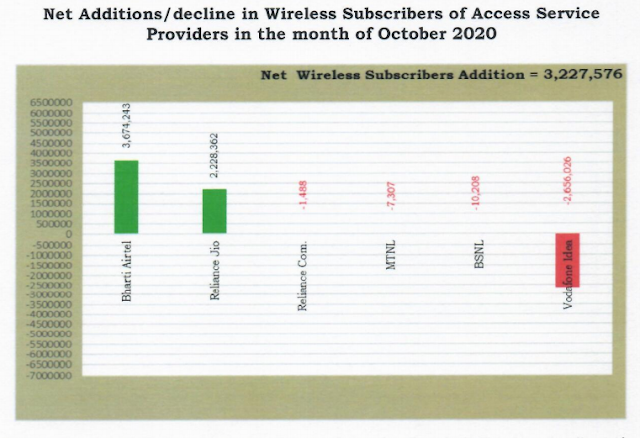

In October 2020, only Bharti Airtel & Reliance Jio shown growth in subscriber base whereas BSNL, MTNL, Vodafone Idea & Reliance Communication shown decline in growth rate.

Vodafone Idea witnessed a massive decline in net addition in customer base in the month of October 2020 where they lost 26.56 lakh existing customers all over India. Reliance Communications, MTNL & BSNL also witnessed decline in net additions in October 2020. Bharti Airtel added maximum number of customers (36.74 lakh) in October 2020 which is followed by Reliance Jio (22.28 lakh).

Total Number of Telephone Subscribers in India

The number of telephone subscribers in India increased from 1,168.66 million at the end of September-2020 to 1,171.80 million at the end of October-2020, thereby showing a monthly growth rate of 0.27%. The overall Tele-density in India decreased from 86.22 at the end of September-2020 to 86.38 at the end of October-2020.

Read More : BSNL’s revised Bharat Fiber (FTTH) Broadband plans are live with 10x more speed and usage; Check them now!

Dear readers, please share your views and opinions about this latest TRAI Report via comments with us.